What is the SWP or Systematic Withdrawal Plan?

Investors have unique financial goals and preferences, leading to diverse strategies in managing their investments. While some may opt for a singular, large-scale investment, others might prefer the consistency and spread of investments via a Systematic Investment Plan (SIP). Distinctively, some investors seek regular returns while others look toward significant capital growth over time.

To cater to these varying investment philosophies, mutual fund houses offer an array of facilities. Among the most strategic are the Systematic Withdrawal Plan (SWP) . Let’s delve deeper into these mechanisms to understand their significance and operation within the realm of mutual funds.

Systematic Withdrawal Plan (SWP): Ensuring Steady Income Streams

A Systematic Withdrawal Plan (SWP) offers a strategic advantage for investors aiming for a regular income from their mutual fund investments. By setting up an SWP, you can withdraw a predetermined amount at regular intervals—be it monthly, quarterly, or annually. This tool is especially beneficial for retirees who need a consistent income stream.

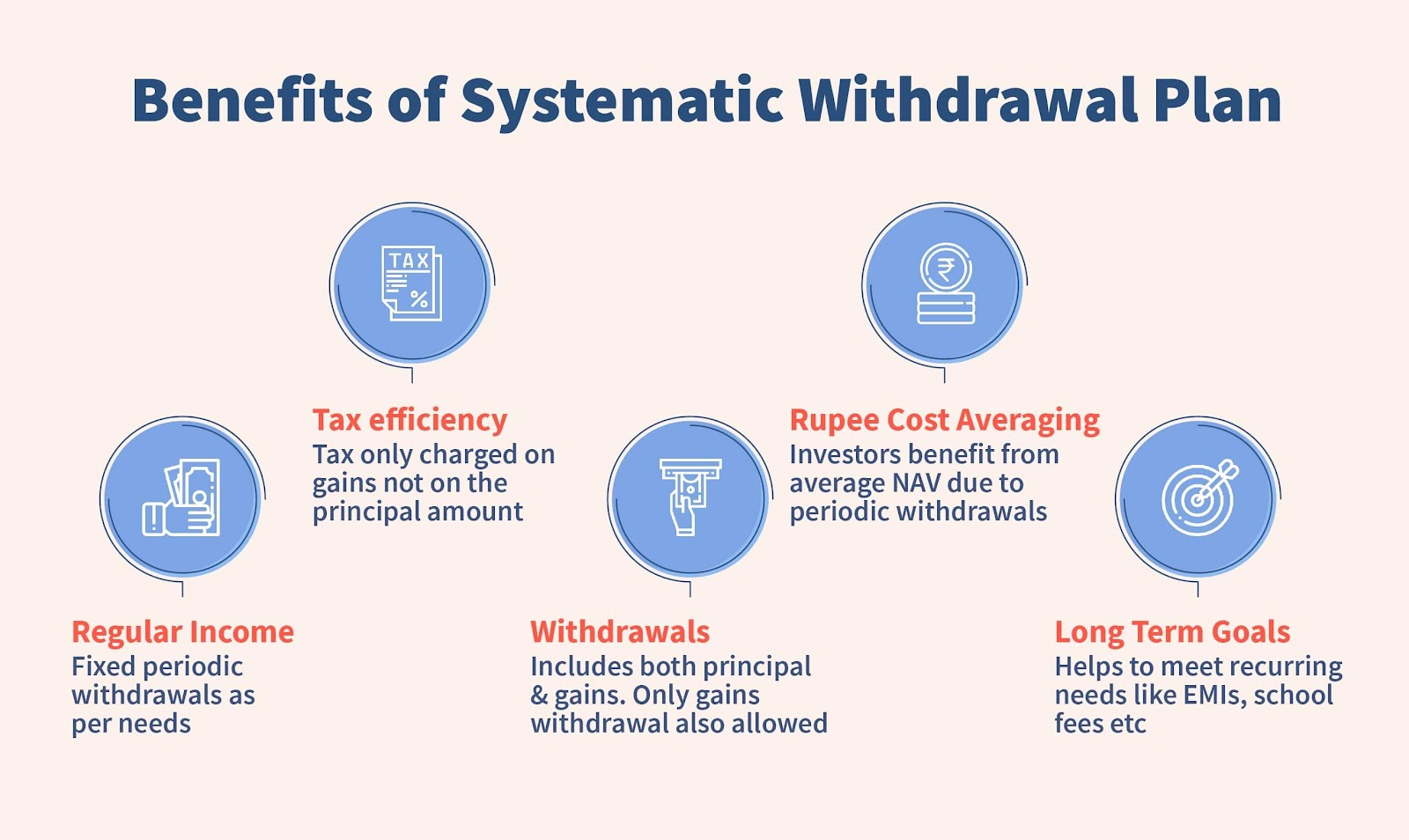

Advantages of SWP:

- Stable Income: Guarantees a fixed income periodically, aiding in financial planning and stability.

- Tax Efficiency: Only the gains portion of the withdrawal is taxed, thus reducing the tax liability compared to other withdrawal mechanisms.

- Investment Discipline: Encourages regular savings and investment, providing financial discipline over the long term.

How Does SWP Work?

When you invest in mutual funds, you’re presented with a choice between dividend and growth plans—each serving distinct investment goals. A growth plan reinvests the profits, allowing the value of the investment to compound and grow over time. On the other hand, a dividend plan pays out profits directly to investors, providing them with periodic income.

An SWP, or Systematic Withdrawal Plan, is particularly flexible, fitting seamlessly with both dividend and growth plans. This versatility makes it an appealing option for investors looking to generate regular income from their investments, irrespective of the underlying mutual fund plan.

Understanding SWP Through a Practical Example

Let’s illustrate how an SWP functions with a simple example: Imagine you have invested Rs. 5 lakhs in a mutual fund. Over five years, this investment appreciates to Rs. 7 lakhs due to the fund’s performance. Now, suppose you decide to initiate an SWP because you need a steady stream of income. You set up the plan to withdraw Rs. 10,000 every month.

Here’s how it works:

- Unit Liquidation: Each month, the mutual fund house will liquidate units from your holdings equivalent to Rs. 10,000.

- Automatic Transfers: The amount is directly credited to your bank account, providing you with the desired monthly income.

- Fund Management: Your remaining investment continues to participate in the market, potentially growing in value depending on the market’s performance and the remaining amount invested.

Exploring the Strategic Advantages of Systematic Withdrawal Plans (SWPs) in Mutual Funds

Systematic Withdrawal Plans (SWPs) offer a robust solution for investors looking to manage their cash flow effectively while maintaining their investment’s growth potential. Here’s an in-depth look at the benefits of SWPs, illustrating why they are an excellent choice for various types of investors:

1. Guaranteed Regular Income

SWPs provide a consistent and reliable income stream, which is especially beneficial for retirees or anyone needing regular cash inflows. This feature allows investors to enjoy a steady income without liquidating their entire investment portfolio, thus preserving the capital to potentially appreciate over time.

2. Disciplined Withdrawal Strategy

The systematic nature of SWPs helps investors avoid impulsive financial decisions that can negatively impact their portfolios. By setting a predetermined withdrawal amount and frequency, investors can smoothly manage their finances without the stress of timing the market.

3. Enhanced Tax Efficiency

One of the significant advantages of SWPs is their tax-efficient withdrawal mechanism. Only the gains portion of each withdrawal is taxed, and if the investment is in debt funds held for more than three years, investors can benefit from indexation, which can substantially reduce the tax liability on the gains.

4. Customizable Withdrawal Options

SWPs offer unparalleled flexibility, allowing investors to tailor the frequency and amount of withdrawals to suit their specific financial needs. This flexibility also includes the ability to pause or modify withdrawals according to changing financial circumstances, providing investors with control over their investment strategy.

Ideal Candidates for SWP

- Senior Citizens: Those looking for a consistent income to supplement their retirement funds.

- Investors with Surplus Funds: Individuals with excess capital can benefit from regular withdrawals while allowing the rest of their capital to potentially increase.

- Risk-Averse Investors: Those preferring systematic withdrawals to mitigate the effects of market volatility on their investments.

- Goal-Oriented Savers: Individuals saving for specific financial goals like a child’s education or major family events can strategically use SWPs to fund these expenses.

- Income Diversifiers: Investors seeking to supplement their primary income source can utilize SWPs to diversify their income streams effectively.

Strategic Applications of SWP

- Creating a Secondary Income Stream: In today’s economy, having an additional source of income can be crucial. SWPs allow investors to tap into their mutual fund investments to create a dependable secondary income, useful for managing the rising cost of living.

- Capital Preservation: For those cautious about risk, investing in low-risk arbitrage mutual funds can provide secure returns. Dividends from these investments can be reinvested in debt funds through a SWP, ensuring capital preservation while generating regular income.

- Building a Retirement Fund: Even without a traditional pension plan, investors can build a retirement corpus by investing in mutual funds tailored to their risk tolerance. Setting up an SWP upon retirement can then provide a regular pension-like income.

SYSTAMATIC WITHDRAWL PLAN

A Systematic Withdrawal Plan (SWP) is a strategic tool for investors seeking a steady income stream from their mutual fund investments. By allowing customizable, regular withdrawals, SWPs not only provide financial flexibility but also enhance tax efficiency, making it an ideal choice for managing long-term investments and retirement funds effectively.

Leveraging SWP as a Strategic Pension Solution

Using a Systematic Withdrawal Plan (SWP) as a pension plan offers retirees a secure and predictable income stream, effectively turning their lump sum investments into a regular paycheck. This approach not only safeguards capital by allowing the remainder of the investment to potentially grow but also ensures financial stability with tax-efficient withdrawals, making retirement years truly golden.